商业银行功能对坦桑尼亚国际贸易的影响探讨

时间:2022-06-04

来源:www.jbevzenko.com

本文是一篇国际贸易论文,这项研究数据分析表明,大多数国际交易商的大部分贸易交易和相关文件均依赖于两家或三家银行(见表4.2)。参考层次回归模型,研究人员发现,银行向贸易交易商发放信用证对国际贸易的发展有积极贡献。研究数据(表4.6)统计表明,信用证缴款单位为0.287。(0.287,p<0.05)。这意味着信用证在很大程度上是支持国际贸易的必要凭证。因此,所有银行必须准确有效地提供所需的标准化信用证。

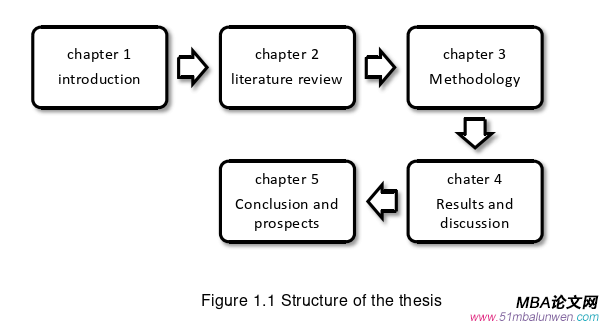

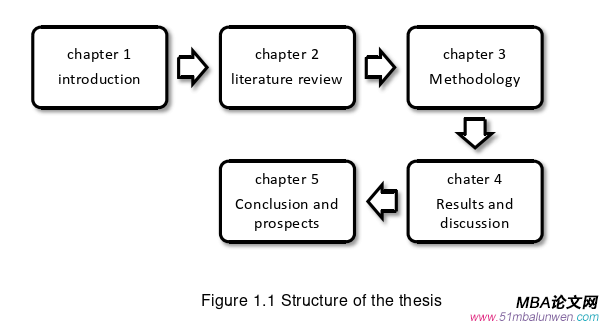

Chapter 1 Introduction

1.1 Background of the study

Banks are key facilitators of international trade and domestic trade. In addition to providing liquidity, they guarantee payment for around a fifth of world trade. For instance, the Financial Trade Authority (2013) reported that trade finance is a key component in maintaining a competitive and productive economy. Banks are the lifeline of business transactions because more than 90 percent of transactions involve some form of credit, insurance, or guarantee (International Trade Center, 2009). Banks are the global barometer of economic wellbeing and business trends. According to Kagunda (2017), advancement in the banking sector has led to international trade risks, ease transactions, increased communication gaps and transformed many exports and imports complication. Extensive literature evidence indicates that more excellent domestic financial development and access to finance can facilitate international trade. It is a fact to suggest that banks aid international trade with guarantees on international payments, thus reducing the risk of trade transactions.

Understanding how banking institutions affect country and firms' internationalization is central to international business. Nowadays, international trade has become inevitable both for companies, individuals and governments (Susmus & Ozgur Baslangic, 2015). Banks represent an essential category of the global transaction services organizations, which embody important aspects of the institutional environment and are important contributors to international business growth (Eriksson et al., 2017). Banks play a critical role in international trade by providing trade finance products that reduce the risk of exporting (Friederike & Schmidt, 2014). Eriksson et al. (2017) argued that banks specialize in screening and monitoring economic agents and supply firms with credit and other financial services. Banks' involvement in international trade is crucial since they facilitate payments and the security of transactions. Domestic banks' representation for home countries and firms is critical to international trade (export and imports). Especially nowadays, the international business has become inevitable both for companies and governments (Susmus & Ozgur Baslangic, 2015).

1.2 Problem statement

As all well-established banks do, Tanzania banks provide specialized, value-added services as a way of growing suitability, tapping a broader market, improve services, and reducing the cost of services. The banks in Tanzania are expected to deliver and support international trade in the foreign exchange marketplace. Multinational commercial banks perform vital roles such as currency conversion, provision of insurance, guarantors, etc. In the quest of international trade commercialization, financial payments and other duties are carried out by banks. Banks, MNOs, and other non-bank institutions have introduced financial transaction services available in industrialized and, increasingly, emerging economies. Among the services are domestic and international money transfers (remittances); deposits and withdrawals; bill and retail payments; payroll services, loan disbursements; repayments and stock exchange trading; and even electronic currencies (Iman, 2018).

Despite the necessity and crucial roles played by banks in international trade, the higher prices of goods, shortages in commodities, and complaints from exporters and imports, there is a deficiency of clarity on how banks influence or support international trade. Given this, research on banks' impact on international business in Tanzania is still relevant. Such empirical studies could serve as a reference for policymakers and interested researchers while boosting inter banks practices.

Chapter 2 Literature Review

2.1 Literature Search

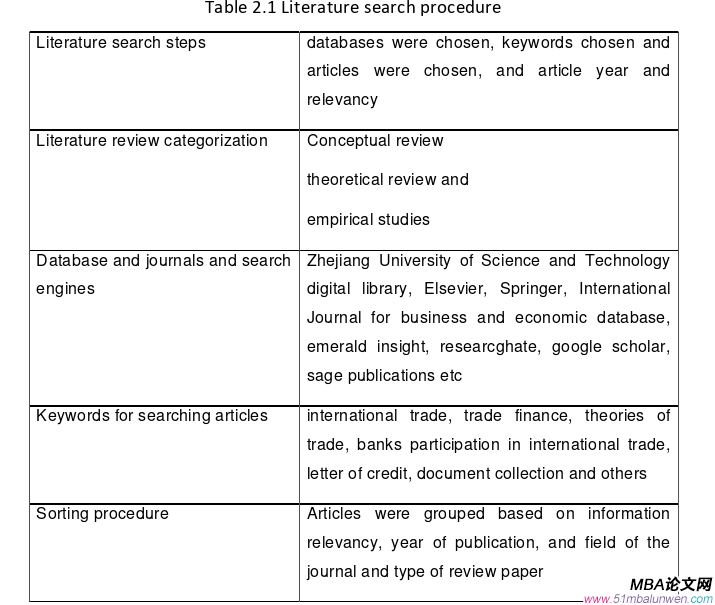

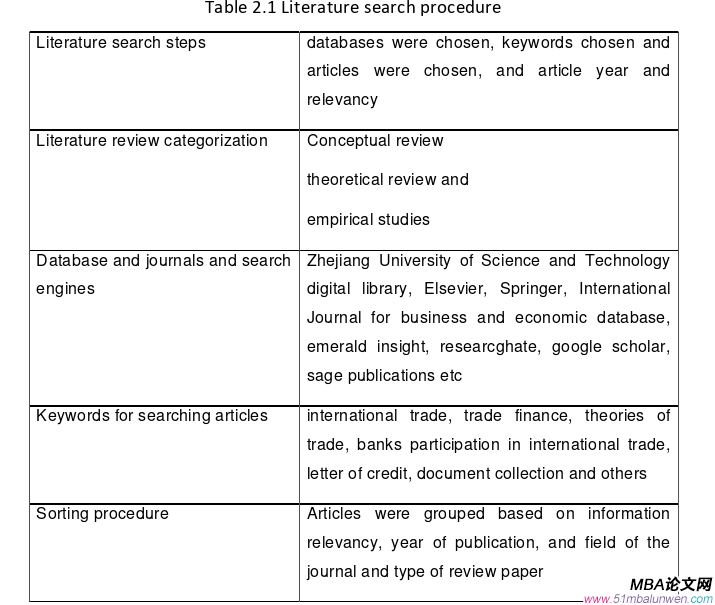

The search for quality literature review is paramount to research studies. This section describes the relevant previous studies about the topic and reviews them chronologically. The literature is categorized into theoretical and empirical reviews, which cover the academic background and the study model, overview of international trade, international trade theories, banks' role, and contribution to international trade. Again, the literature search was done using these keywords; international trade, trade finance, trade theories, banks participation in international trade, letter of credit, document collection and others. Furthermore, articles or papers were downloaded from credible databases and journals, books (Zhejiang University of Science and Technology digital library, Elsevier, Springer, International Journal for business and economic database, emerald insight, researchable, google scholar, sage publications, etc.). The process for the literature review is explained in table 2.1.

2.2 Empirical Review

2.2 Empirical Review

This section presents previous research studies, their findings, conclusions and perspective on banks and international trade. The concepts within the topic under investigation are thoroughly reviewed and discussed.

Overview of international trade

No country can exist in isolation, international cooperation and trade antecedent of economic power and growth, and industrialization. The unequal distributions of resources and globalization have resulted in interdependency among nations. Because of this, both the developed and developing nations engage in international trade. Tian et al. (2018) asserted that nations seek out the business to aid in their economic development, and countries seek out a share of the "trade pie". Global trade has led to international economic integration that systemically links nations, and plays an important role in affecting sustainable economic development and ecological dynamics amongst nations (Jomo and Rudiger, 2009). International trade flows are associated with comparative advantages for nations and regions.

International trade refers to the transfer of goods and services, including capital goods from one country to another. This definition is agreed by Economics Concepts (2012) who defines it as trade across international borders. In most countries, this trade A large share of gross domestic product. While international trade has been present throughout history, its economic, social, and political importance has been on the rise in recent centuries. Therefore, nations would be limited to the goods and services produced within their borders without international trade. However, Economics Concept (2012) adds that the difference between international trade and domestic trade is that this type of trade is more costly than domestic trade.

Chapter 3 Theoretical Foundation and Methodology ................................ 38

3.1 Transactional cost theory ............................... 38

3.2. Measurement of variables .................................. 40

Chapter 4 Results and Discussion ................................. 48

4.1 Respondents background Statistics ........................................... 48

4.2 Banks contribution to international trade in Tanzania .......................... 50

Chapter 5 Conclusion and Prospects ................................. 86

5.1 Conclusion ............................... 86

5.2 Recommendations .............................. 88

Chapter 4 Results and Discussion

4.1 Respondents background Statistics

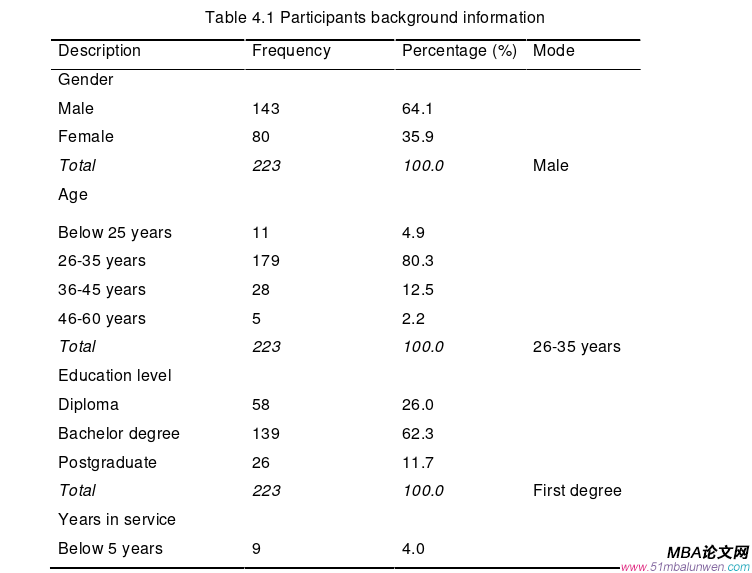

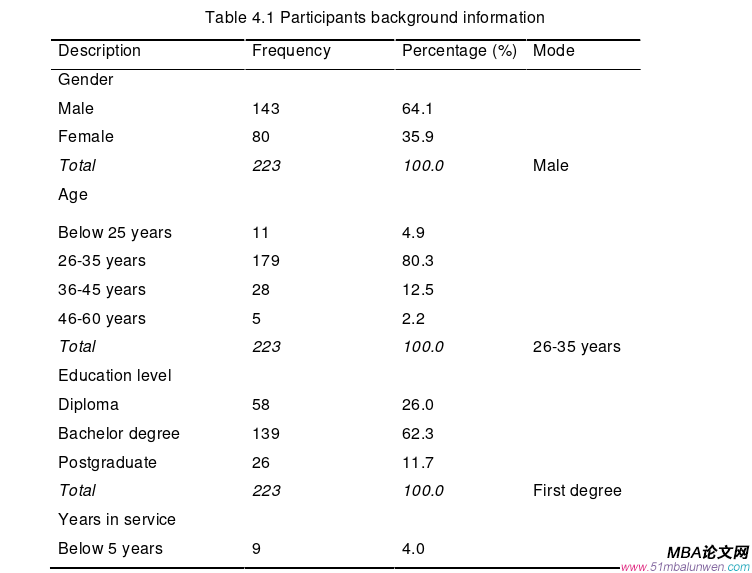

The study discovers the background characteristics of all the participants. Some of the details include gender, age of the respondents, educational level, years in service and asset of business in Tanzania Shilling

Table 4.1 revealed that more males (64.1%) were represented than females (35.9%). These results confirmed the majority of the respondents are male. A greater proportion of the participants are within 26-35 years, representing 80.3%, with 2.2% representing 46-60 years of age. In terms of respondents' educational achievement level, it is found that 139 participants, which constitute 62.3% were bachelor degree holders, 26% were diploma, and the postgraduates were 11.7%.

Table 4.1 revealed that more males (64.1%) were represented than females (35.9%). These results confirmed the majority of the respondents are male. A greater proportion of the participants are within 26-35 years, representing 80.3%, with 2.2% representing 46-60 years of age. In terms of respondents' educational achievement level, it is found that 139 participants, which constitute 62.3% were bachelor degree holders, 26% were diploma, and the postgraduates were 11.7%.

Chapter 5 Conclusion and Prospects

5.1 Conclusion

This study involved 223 participants, who are mainly international trade dealer, financial sector employees from various banks in Tanzania and other custom or foreign bureau department. The researcher applied descriptive statistics, correlation matrix, multiple and logistics regression model to examine the contribution of banks to international trade in the country.

First, the data analysis reported that majority of international dealers depend on averagely two or three banks for most of their trade transactions and related documents (see table 4.2). Referring to the hierarchical regression model, the researcher discovered that banks giving out letter of credit to trade dealers positively contribute to the development of international trade. The study data (table 4.6) statistically suggest that the letter of credit unit of contribution is 0.287. (0.287, p < 0.05). This means that letter of credit is significantly a necessary document that support international trade. All banks must therefore provide the needed and standardized LC accurately and effectively.

Under today international trade activities, document collection is still relevant despite increase in advance technology that speed up foreign trade process. Yet, document collection is vital to complete the trade cycle procedure. Interestingly, the study observed that DC and international trade is positively related.

reference(omitted)

Chapter 1 Introduction

1.1 Background of the study

Banks are key facilitators of international trade and domestic trade. In addition to providing liquidity, they guarantee payment for around a fifth of world trade. For instance, the Financial Trade Authority (2013) reported that trade finance is a key component in maintaining a competitive and productive economy. Banks are the lifeline of business transactions because more than 90 percent of transactions involve some form of credit, insurance, or guarantee (International Trade Center, 2009). Banks are the global barometer of economic wellbeing and business trends. According to Kagunda (2017), advancement in the banking sector has led to international trade risks, ease transactions, increased communication gaps and transformed many exports and imports complication. Extensive literature evidence indicates that more excellent domestic financial development and access to finance can facilitate international trade. It is a fact to suggest that banks aid international trade with guarantees on international payments, thus reducing the risk of trade transactions.

Understanding how banking institutions affect country and firms' internationalization is central to international business. Nowadays, international trade has become inevitable both for companies, individuals and governments (Susmus & Ozgur Baslangic, 2015). Banks represent an essential category of the global transaction services organizations, which embody important aspects of the institutional environment and are important contributors to international business growth (Eriksson et al., 2017). Banks play a critical role in international trade by providing trade finance products that reduce the risk of exporting (Friederike & Schmidt, 2014). Eriksson et al. (2017) argued that banks specialize in screening and monitoring economic agents and supply firms with credit and other financial services. Banks' involvement in international trade is crucial since they facilitate payments and the security of transactions. Domestic banks' representation for home countries and firms is critical to international trade (export and imports). Especially nowadays, the international business has become inevitable both for companies and governments (Susmus & Ozgur Baslangic, 2015).

1.2 Problem statement

As all well-established banks do, Tanzania banks provide specialized, value-added services as a way of growing suitability, tapping a broader market, improve services, and reducing the cost of services. The banks in Tanzania are expected to deliver and support international trade in the foreign exchange marketplace. Multinational commercial banks perform vital roles such as currency conversion, provision of insurance, guarantors, etc. In the quest of international trade commercialization, financial payments and other duties are carried out by banks. Banks, MNOs, and other non-bank institutions have introduced financial transaction services available in industrialized and, increasingly, emerging economies. Among the services are domestic and international money transfers (remittances); deposits and withdrawals; bill and retail payments; payroll services, loan disbursements; repayments and stock exchange trading; and even electronic currencies (Iman, 2018).

Despite the necessity and crucial roles played by banks in international trade, the higher prices of goods, shortages in commodities, and complaints from exporters and imports, there is a deficiency of clarity on how banks influence or support international trade. Given this, research on banks' impact on international business in Tanzania is still relevant. Such empirical studies could serve as a reference for policymakers and interested researchers while boosting inter banks practices.

Chapter 2 Literature Review

2.1 Literature Search

The search for quality literature review is paramount to research studies. This section describes the relevant previous studies about the topic and reviews them chronologically. The literature is categorized into theoretical and empirical reviews, which cover the academic background and the study model, overview of international trade, international trade theories, banks' role, and contribution to international trade. Again, the literature search was done using these keywords; international trade, trade finance, trade theories, banks participation in international trade, letter of credit, document collection and others. Furthermore, articles or papers were downloaded from credible databases and journals, books (Zhejiang University of Science and Technology digital library, Elsevier, Springer, International Journal for business and economic database, emerald insight, researchable, google scholar, sage publications, etc.). The process for the literature review is explained in table 2.1.

This section presents previous research studies, their findings, conclusions and perspective on banks and international trade. The concepts within the topic under investigation are thoroughly reviewed and discussed.

Overview of international trade

No country can exist in isolation, international cooperation and trade antecedent of economic power and growth, and industrialization. The unequal distributions of resources and globalization have resulted in interdependency among nations. Because of this, both the developed and developing nations engage in international trade. Tian et al. (2018) asserted that nations seek out the business to aid in their economic development, and countries seek out a share of the "trade pie". Global trade has led to international economic integration that systemically links nations, and plays an important role in affecting sustainable economic development and ecological dynamics amongst nations (Jomo and Rudiger, 2009). International trade flows are associated with comparative advantages for nations and regions.

International trade refers to the transfer of goods and services, including capital goods from one country to another. This definition is agreed by Economics Concepts (2012) who defines it as trade across international borders. In most countries, this trade A large share of gross domestic product. While international trade has been present throughout history, its economic, social, and political importance has been on the rise in recent centuries. Therefore, nations would be limited to the goods and services produced within their borders without international trade. However, Economics Concept (2012) adds that the difference between international trade and domestic trade is that this type of trade is more costly than domestic trade.

Chapter 3 Theoretical Foundation and Methodology ................................ 38

3.1 Transactional cost theory ............................... 38

3.2. Measurement of variables .................................. 40

Chapter 4 Results and Discussion ................................. 48

4.1 Respondents background Statistics ........................................... 48

4.2 Banks contribution to international trade in Tanzania .......................... 50

Chapter 5 Conclusion and Prospects ................................. 86

5.1 Conclusion ............................... 86

5.2 Recommendations .............................. 88

Chapter 4 Results and Discussion

4.1 Respondents background Statistics

The study discovers the background characteristics of all the participants. Some of the details include gender, age of the respondents, educational level, years in service and asset of business in Tanzania Shilling

Chapter 5 Conclusion and Prospects

5.1 Conclusion

This study involved 223 participants, who are mainly international trade dealer, financial sector employees from various banks in Tanzania and other custom or foreign bureau department. The researcher applied descriptive statistics, correlation matrix, multiple and logistics regression model to examine the contribution of banks to international trade in the country.

First, the data analysis reported that majority of international dealers depend on averagely two or three banks for most of their trade transactions and related documents (see table 4.2). Referring to the hierarchical regression model, the researcher discovered that banks giving out letter of credit to trade dealers positively contribute to the development of international trade. The study data (table 4.6) statistically suggest that the letter of credit unit of contribution is 0.287. (0.287, p < 0.05). This means that letter of credit is significantly a necessary document that support international trade. All banks must therefore provide the needed and standardized LC accurately and effectively.

Under today international trade activities, document collection is still relevant despite increase in advance technology that speed up foreign trade process. Yet, document collection is vital to complete the trade cycle procedure. Interestingly, the study observed that DC and international trade is positively related.

reference(omitted)

相关阅读

- 汇率对俄罗斯对外贸易的影响2018-01-30

- 我国生产性服务贸易国际竞争力影响因素的实证研究2018-03-09

- 京津冀服务贸易竞争力影响因素研究2018-03-18

- 中国农产品企业国际贸易市场进入模式选择研究2018-03-28

- 结构突变下国际原油价格与中美股票价格的波动溢出效应2018-04-20

- 我国重化工业产业调整与转移对区域碳排放差异贸易影响2018-05-31

- 中国出口对国内消费贸易需求的挤出效应研究2018-06-25

- 中国对西亚四国出口贸易的驱动效应及其影响因素2018-07-14

- 碳补贴政策下供应链企业一体化国际贸易策略选择2018-07-29

- 碳配额不同分配机制下供应链碳减排策略及国际贸易...2018-08-16